How Defi Will Change The Game Of Finance

When Satoshi created Bitcoin, he had the vision of a global financial system free from centralized control. Decentralized Finance, also known as DeFi, is a novel alternative to traditional finance that has steadily been gaining popularity.

Finance has long been regarded as a difficult issue to discuss, but it impacts everyone. This blog is intended to discuss DeFi for beginners.

DeFi refers to financial applications based on blockchain technology that permit multiparty digital transactions. The blockchain is essentially a public ledger for digital assets, such as cryptocurrencies.

Additionally, DeFi is "decentralized" because it occurs without the involvement of a central authority, banks, or other traditional financial entities. DeFi, which was nonexistent only a few years ago, has since developed into a multibillion-dollar industry.

Similar to how the Internet is a free medium for sending and receiving data, DeFi provides a free, open, transparent, and scalable financial system. DeFi is a two-party contract exclusively.

What’s The Issue In Traditional Finance?

There are several issues in Traditional Finance also known as TradFi

1. Centralized Data And Anonymity

The term "KYC" (know your customer), which refers to processes used by financial firms to confirm a client's identity and legality before doing business with them. In other words, a consumer needs to show that they are who they claim to be.

A bank will very certainly check every single piece of information about you if you apply for a loan, including your address, assets, marital status, frequency of job changes, bank balance, past loans, and even your social media activity.

All of finance is dependent on trust, and financial institutions are able to determine who can and cannot access their services with minimal transparency. This results in many users being treated unfairly.

In DeFi, customers don’t need to provide any personal information to access services.. All you need to use DeFi services is money and an internet connection. DeFi participants interact with a "smart contract," which is computer code that serves as the middleman to ensure that everyone fulfills their obligations, rather than going via financial institutions. DeFi supported "access" by doing away with middlemen in order to establish a flexible, universal financial system free from restrictions.

Also Read: What is a DAO in DeFi

2. Paperwork, paperwork and a lot of paperwork

In traditional finance a lot of time and documentation is often needed for simple tasks like opening a bank account. Many traditional banks have a minimum deposit requirement, along with excessive transaction charges and fees.

Also Read: Learn how to create a crypto wallet here.

3. Who Owns Your Money?

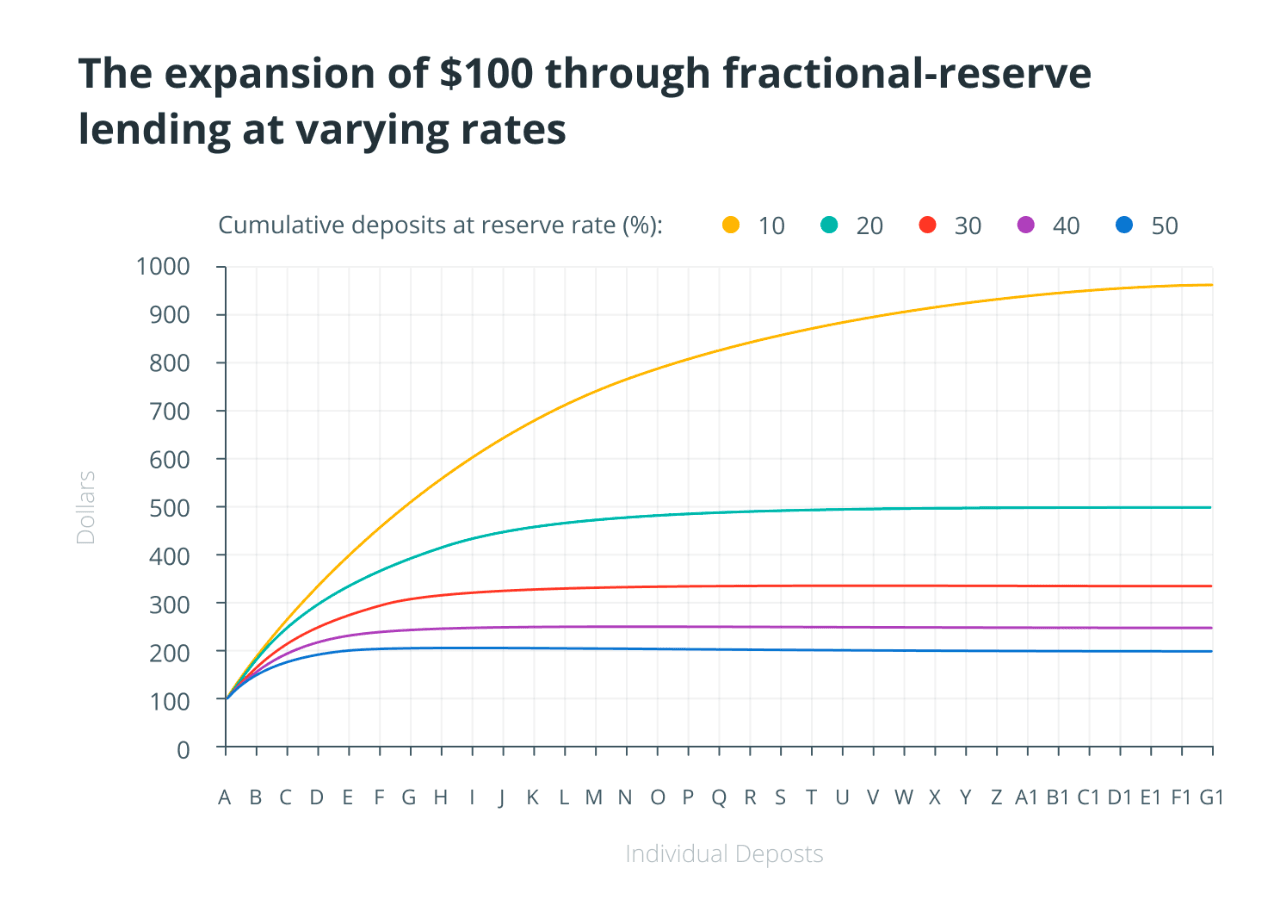

You just receive a paycheck in your bank account and you’re receiving a tiny fraction of interest on your money. Isn’t it? But the bank is using approximately 90% of your money to invest or loan to other people and institutions. In case if you want to withdraw your money altogether the banks may ask a lot of questions, throw some withdrawal charges on you, and even can report to Govt authorities citing tax evasion. So it’s clear, banks don’t want you to take your money out of the system. Instead they’re taking a slight risk and diversifying your money to earn more money.

A large portion of wealth is invested in sophisticated financial products that, as the 2008 crisis showed, may be highly vulnerable to credit defaults.

In DeFi, It’s your money, your risk, and your rewards. No middlemen involved.

Also Read: Mistakes To Avoid As A New DeFi User

4. Data Storage And Availability

In traditional finance, institutions use centralized data centers to store the majority of your data, including sensitive information. These institutions operate according to standard office hours, making the majority of its functions unavailable on weekends and holidays. Most bank deposits, loans, and borrowing cannot be completed after business hours.

In the case of DeFi, it operates on a blockchain that is constantly active and is available online. Therefore, even at Sunday Midnight, if you need to stake an asset, you can do so without difficulty.

Also Read: How To Stay Safu In Defi?

DeFi is not just an idea anymore

If you’re new to DeFi, then it’s likely that you heard about DeFi for a reason.

- $40.63B is currently locked in the DeFi smart contracts on the date of writing this blog as per the Defi Pulse

- On Nov 09, 2021, the amount of USD locked up in DeFi crossed $97 billion.

The foundation of the economy continues to be conventional finance. Many people still choose to lend and borrow money in the conventional manner. However, DeFi users are multiplying quickly. Given the numerous advantages of this system, it has a strong likelihood of dislodging the current financial system in the not-so-distant future.

DeFi's key advantages are its trustless nature, accessibility, convenience, transparency, and potential for developing new financial products. By utilizing DeFi applications, users can stay clear of all the difficulties present in the conventional financial system.

Education is a valuable tool in the world of finance. To help demonstrate the advantages provided by DeFi, we're breaking down every complicated DeFi topic in our Education Section.

While DeFi is already proving itself as an alternative to the traditional financial system, there is still a lot or room for improvement before billions of people can be onboarded. Umee is helping bring DeFi to everyone by building a cross-chain infrastructure that acts as the foundation for DApps and financial Legos.

Stay tuned for more informative blog posts.