UMEE Token Economics

UMEE is the Umee blockchain’s native token. The main purpose of the UMEE token is to power the PoS consensus of the Umee blockchain while allowing the community to use and govern Umee and the applications built on top.

Utility

1) Validator Infrastructure

The Umee Blockchain is built on a network of validators that contribute Tendermint BFT consensus to the protocol. Tokens are bonded to validators that stake to provide Proof of Stake consensus to the network. Validators come from an open ecosystem of contributors and infrastructure providers. Tokens can also be delegated to validators by users to participate in the underlying consensus mechanism. This helps ensure the Umee network remains decentralized.

2) Network Fees & PoS Consensus

Network fees will be earned in the form of UMEE tokens by validator infrastructure providers.

Similar to how ETH is used as a gas fee to pay for transactions on the Ethereum blockchain, UMEE is used as a gas fee to pay for transactions on the Umee Blockchain.

Validators earn block rewards in the form of UMEE similar to how transaction fees are processed in native blockchain protocols.

3) Protocol Governance

The native UMEE token is also a protocol governance token used to facilitate on-chain governance for the Umee Blockchain. The UMEE token, when staked, can be used to vote on protocol parameters and upgrades for improving functionality of the blockchain infrastructure. The UMEE token will also govern DeFi parameters of applications that sit on top, community grants, and future development.

Token Format

The UMEE token will exist in both ERC-20 and Cosmos SDK (native) formats. Users will be able to stake the native version of the UMEE token to the Umee blockchain to participate in the PoS consensus and earn staking rewards. If users want to convert from one blockchain to another, all they need to do is transfer them through the Umee web app; such transactions will take sub-minutes powered by Umee’s gravity bridge.

Learn more about the two types of UMEE tokens here.

Token Distribution & Release Schedule

There is a total supply of 10 billion UMEE tokens, uncapped, with an inflation and deflation mechanism in place to align the UMEE token distribution with long term Umee supporters over time.

Supply is allocated as follows:

UMEE Token Distribution

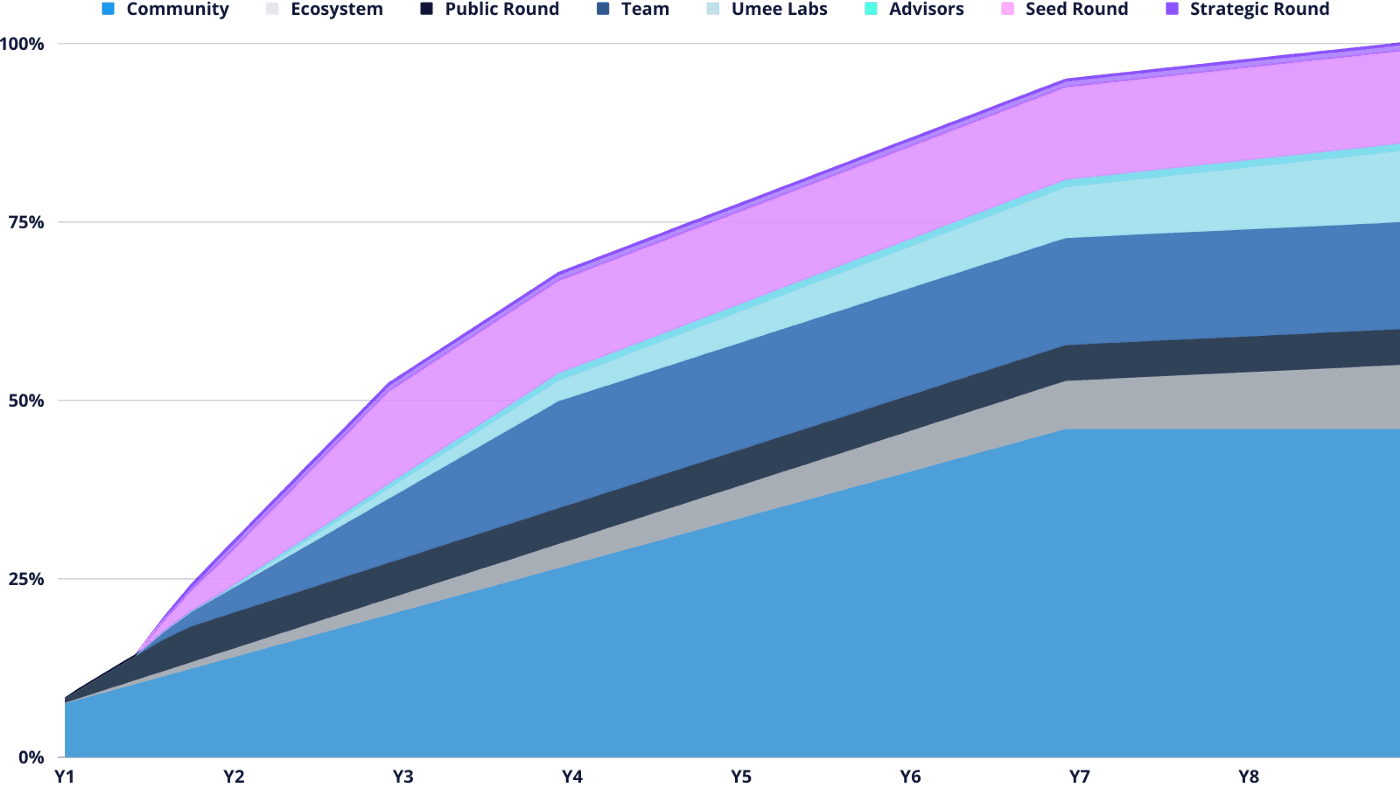

UMEE Token Release Schedule

Community

46% of the genesis supply is reserved for the community. Umee community governance will determine how and when to distribute these tokens through various incentive and grant programs. DAOs can be set up through community votes in order to effectively lead and reward efforts of building sustainable value. All types of contributors can be eligible for community token incentives, including but not limited to technical contributors, community builders, educators, and liquidity providers.

7% of the Community tokens are liquid at the TGE on or around February 15th, 2022; the majority of it is structured as a loan to the market makers of the UMEE tokens, and the rest will be distributed as community incentives to bootstrap the Umee network. The remaining 39% of the tokens will be vested linearly for six years starting at the TGE.

Ecosystem

9% of the genesis supply is allocated for the ecosystem. Umee community governance will decide how to use these tokens to best incentivize developers to build on top of the Umee blockchain and further build out the ecosystem. These tokens may also be burned if the community chooses to do so.

These tokens will be vested linearly for eight years starting at the TGE on or around February 15th, 2022.

Public Round

5% of the genesis supply goes to community members who participated in Umee’s public sale on Coinlist.

These tokens will be vested linearly for eight to ten months depending on the sale option selected, starting at the TGE on or around February 15th, 2022.

Private Rounds

14% of the genesis supply is allocated to early investors who participated in one of Umee’s two private rounds.

These tokens are subject to a six month cliff which will begin at the TGE on or around February 15th, 2022. After six months, 1% of these tokens will be vested linearly for six months while the remaining 13% will be vested linearly for eighteen months.

Team

15% of the genesis supply is reserved for the Umee team. These tokens will be used to help attract new talent and reward Umee team members for their work. The goal of the Umee team is to attract and collaborate with the best talents and teams around the globe. A portion of the team tokens are set aside for ongoing grants to support the development of Umee as well as open source components of the Umee ecosystem.

These tokens are subject to a six month cliff which will begin at the TGE on or around February 15th, 2022. After six months, these tokens will be vested linearly for thirty months.

Umee Labs

10% of the genesis supply is allocated to Umee Labs, the corporate entity that funded the development of the Umee protocol and is owned by the founding team. In order to best align the long term interest of the Umee community and not receive tokens in advance of any other Umee participants, the entity has an eight year lockup schedule, beginning with a twelve month cliff.

These tokens are subject to a twelve month cliff which will begin at the TGE on or around February 15th, 2022. After twelve months, these tokens will be vested linearly for eighty-four months.

Advisors

1% of the genesis supply goes to advisors who have tremendously helped and continue to help guide Umee along its journey.

These tokens are subject to a six month cliff which will begin at the TGE on or around February 15th, 2022. After six months, these tokens will be vested linearly for 30 months.

Inflation & Deflation Mechanisms

Inflation

Umee’s inflation schedule changes slowly based on a targeted staking participation rate. When the network reaches the targeted staking rate, the inflation rate will remain constant. When the network has more than the targeted staking rate, the inflation rate will decrease gradually until reaching 7%, the floor inflation rate. When the network has less staked, the inflation rate will increase gradually until reaching 14%, the ceiling inflation rate.

The dynamic inflation rate and the staking mechanism of the Umee blockchain is the ultimate security mechanism that guarantees the security of the Umee network.

Deflation

Of the platform fees generated by the initial borrowing and lending functionality, community governance can make decisions regarding buybacks and burns of UMEE tokens. Additional deflation of the token supply will occur via governance determined mechanisms.

In the future community governance can also make decisions related to the usage of the Community and Ecosystem portions of the tokens, such as additional burning mechanisms and plans for the Community and Ecosystem tokens, based on the future market practice and industry trends for the best long term development of Umee.

How to Purchase UMEE Tokens?

Before February 15th, 2022, the UMEE token is unavailable for purchase.

More information about how and where to buy UMEE will be provided soon. Make sure you’re following Umee on Twitter and have joined the Umee Discord in order to get the latest updates.

Anyone offering to sell you UMEE at this time is a scammer. Please do not engage with scammers, and report any scams in the #scam-alert channel on the Umee Discord.

Join the Umeeverse!

If you’d like to get involved right now, you can help out by:

- Trying out Umee’s Testnet Web App;

- Creating and sharing educational Umee content;

- Translating important documentation and user guides;

- Enhancing Umee’s social media presence;

- Contributing to the technical discussion and development of Umee;

- Helping out other Umee community members.