What is Staking? Explained

TLDR

On Proof of Stake blockchains like Umee, users can lock up their crypto as collateral to help keep the blockchain operational and secure in a process called “staking.” In return for staking tokens users earn steady “staking rewards,” or newly minted units of crypto. Users who do not stake their tokens are penalized by having their market share diluted over time.

What Is Proof of Stake?

Proof of Stake (PoS) is a blockchain consensus mechanism that requires network participants called “validators” to lock up crypto as collateral in order to be eligible to validate and include transaction data to the blockchain in return for newly minted units of crypto called “block rewards.” Validators who fail to properly participate in the PoS consensus are penalized by having a portion of their collateral “slashed,” or removed, therefore validators are financially incentivized to keep the blockchain operational and secure.

What Are Block Rewards?

Block rewards are an economic incentive used to motivate a distributed set of validators to follow a blockchain’s rules in order to reach consensus in a decentralized way.

Block rewards are newly minted units of crypto that are issued to network participants in return for their role in running and securing a network.

The validator infrastructure on many PoS blockchains like Umee often rely on tokens that are inflationary by design. The use of inflationary tokens to secure a blockchain helps incentivize token holders to contribute to the security of the network by staking their tokens in order to earn a portion of block rewards. Block rewards penalize token holders who do not contribute to the security of the network by diluting their market share over time.

Read Also: What is Cosmos DeFi?

What Happens When Tokens Are Staked?

By staking tokens a user is helping secure a network by increasing the total amount staked and therefore increasing the difficulty for an attacker to take over the network. When tokens are staked on PoS networks like Umee, a token holder is “delegating” their tokens to a validator. These tokens are locked up and added to a validator's “stake,” or total collateral, and are no longer usable or transferable while staked. Token holders are able to undelegate their tokens at any time, although there may be an “unbonding period,” or a mandatory waiting period between when a user undelegates their tokens and when the tokens can be used. The Umee blockchain has a 14 day unbonding period.

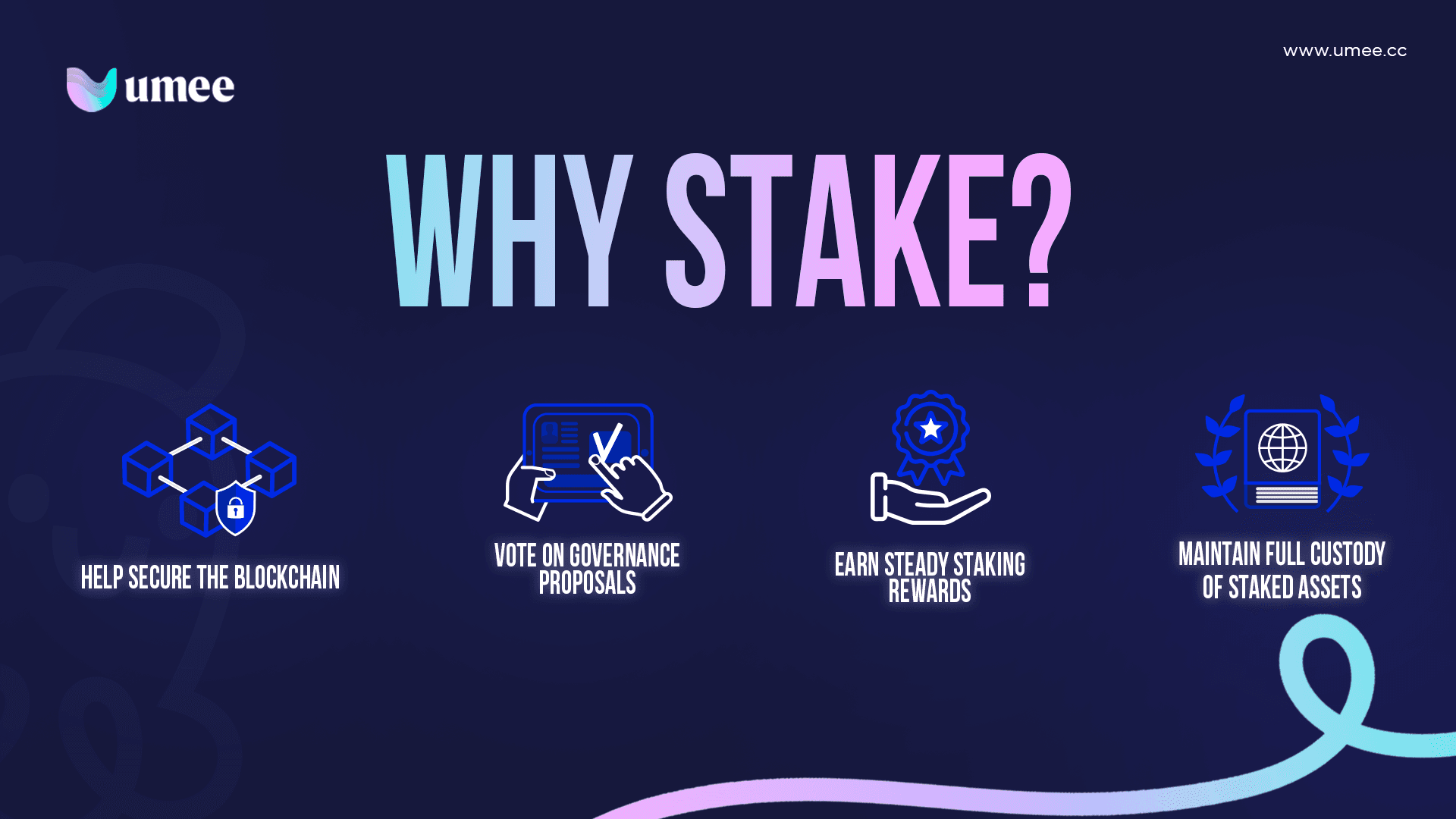

When delegating, token holders maintain full custody of the staked assets; validators are unable to confiscate staked tokens if they wanted to. Validators can be thought of as elected officials in a representative democracy, and delegators can be thought of as the community that elected them. While anyone who stakes tokens can vote on governance proposals to help shape the future of a network, it is a validator’s duty to stay informed and actively participate in governance in order to advance the interests of their delegators and add value to the network. The more tokens a validator stakes, the greater their “voting power,” or ability to influence governance decisions becomes.

It is recommended that users assess various criteria including voting power, voting participation, and general governance stances when selecting a validator. Delegate to active validators with less voting power to help support the decentralization and security of the network!

Why Should You Stake?

Staking rewards are considered the steadiest, lowest risk yield in crypto. Validators earn block rewards according to the total amount of tokens they have staked, and these block rewards are typically redistributed to delegators proportional to the amount of tokens they have delegated. This allows users who are unable to operate a validator node to safely earn staking rewards while helping secure the network. Users who fail to stake their tokens are penalized by having their market shares diluted over time.

Additionally, users who stake tokens are able to participate in governance to help shape the future of a network. When users fail to vote on a governance proposal, their votes are inherited by the validator they delegated their tokens to.

Are There Any Risks to Staking?

Staked tokens are a form of collateral used to ensure validators do their job. If a validator misbehaves, a portion of their total stake is removed or “slashed.” This means that everyone who has delegated tokens to this validator will have their tokens slashed proportionately.

Slashing is very rare because validators are financially incentivized to do their job.

The most severe offense a validator can commit on the Umee blockchain results in 5% of their total stake being slashed, meaning that delegators would lose 5% of the tokens they delegated to this validator if the validator misbehaves.

How Do Validators Profit?

Validators earn a profit for the services provided by charging a commission for all staking rewards accrued. Users who delegate to a validator do not pay anything out of pocket, but rather grant the validator permission to collect a percentage of the total staking rewards earned.

How To Stake

In order to stake UMEE tokens and start earning steady staking rewards, users should: